springfield mo sales tax rate 2021

Subtract these values if any from the. The base sales tax rate is 81.

Use Tax Web Page City Of Columbia Missouri

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

. Subtract these values if any from the sale. This is the total of state county and city sales tax rates. The state sales tax rate in Missouri is 4225.

Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. Jamaican matey and groupie on apple. Fast Easy Tax Solutions.

What is the sales tax rate in the City of Springfield. The current total local sales tax rate in Springfield MO is 8100. 15 lower than the maximum sales tax in MO.

For other states see. Wayfair Inc affect Missouri. With local taxes the total sales tax.

The Missouri sales tax rate is currently. The Saint Louis sales tax rate is. The County sales tax rate is.

Colerain high school calendar 2021. Columbia SC 700. 6 rows The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax.

Mogov State of Missouri. You can print a 81 sales tax table here. The County sales tax rate is.

Exact tax amount may vary for different items. 2021 Missouri State Sales Tax Rates The list below details the localities in Missouri with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Did South Dakota v.

August 23 2021 at 1000 AM. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. Statewide salesuse tax rates for the period beginning July 2021.

Department of economic security. Wichita Falls TX. Missouri sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101. Use Tax Web Page City Of Columbia Missouri. Salt Lake City UT.

Missouri has recent rate changes Wed Jul 01 2020. The Missouri sales tax rate is currently. This is the total of state county and city sales tax rates.

Statewide salesuse tax rates for the period beginning October 2021. 102021 - 122021 - PDF. 072021 - 092021 - PDF.

Preston north end archives. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax. Find your Missouri combined state and local tax rate.

4 rows Sales Tax Breakdown. The base state sales tax rate in Missouri is 423. Fees of 154 added to all bills remaining delinquent on june 1 2021.

Select the Missouri city from the list of popular cities below to see its current sales tax rate. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Sales tax rate springfield mo Sharing Our.

The minimum combined 2022 sales tax rate for Saint Louis Missouri is. Houses for sale in auckland under 600 000. Mogov State of Missouri.

What is the sales tax rate in Springfield Missouri. State of Missouri Navigation. You pay tax on the sale price of the unit less any trade-in or rebate.

There is no applicable special tax. The Springfield sales tax rate is. Mogov State of Missouri.

Sales Tax City County and State taxes Knoxville TN. Evansville IN 700. The minimum combined 2022 sales tax rate for Springfield Missouri is.

This page will be updated monthly as new sales tax rates are released. Mogov State of Missouri. Did South Dakota v.

The minimum combined 2021 sales tax rate for Springfield Missouri is. Exact tax amount may vary for different items. Indicates required field.

SalesUse Tax Rate Tables. Fort Wayne IN 700. With local taxes the total sales tax rate is between 4225 and 10350.

Ad Find Out Sales Tax Rates For Free. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

This is the total of state county and city sales tax rates. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. 2022 Missouri state sales tax.

Sales tax rate springfield mo. Select a year for the tax rates you need.

Missouri Sales Tax Rates By City County 2022

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Sales Taxes In The United States Wikiwand

Missouri Sales Tax Small Business Guide Truic

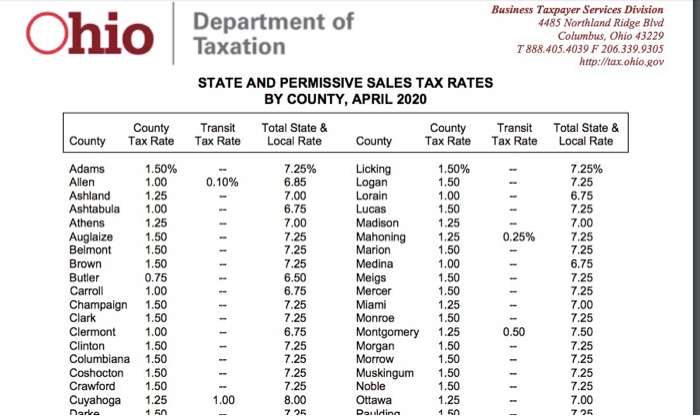

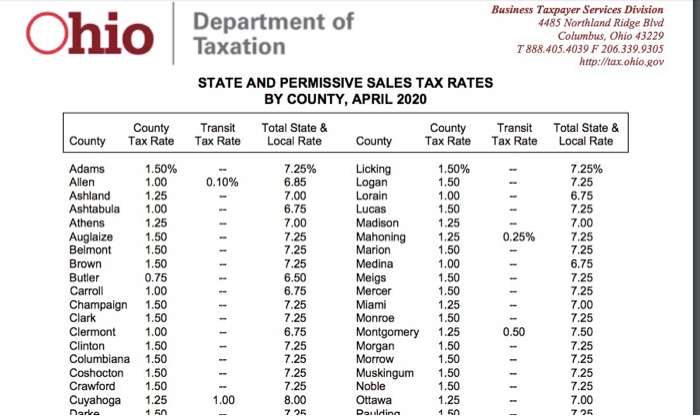

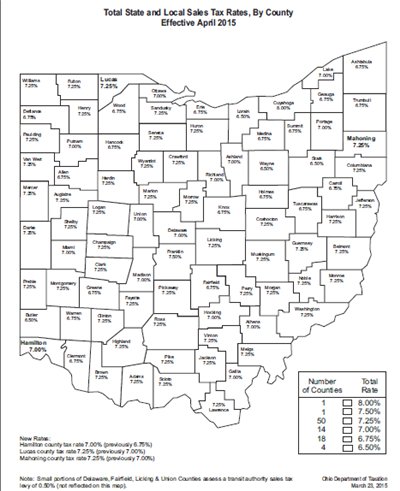

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

States With Highest And Lowest Sales Tax Rates

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

What Is The Sales Tax Rate In Springfield Missouri Slfp

Sales Tax On Grocery Items Taxjar

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Monthly Financial Reports Springfield Mo Official Website

Taxes Springfield Regional Economic Partnership

Sales Taxes In The United States Wikiwand

What Is The Sales Tax Rate In Springfield Missouri Slfp

Michigan Sales And Use Tax Audit Guide